The Securities and Exchange Board of India (SEBI) has introduced a new structure called Specialized Investment Fund (SIF). It aims to provide investors with an option that bridges the gap between Mutual Funds (MF) and Portfolio Management Services (PMS).

Specialized Investment Funds (SIF)

The SIF framework allows for diverse investment strategies, which can be structured as open-ended, close-ended or interval-based. The minimum investment in the scheme is Rs. 10 Lakhs and it offers a higher degree of flexibility to the fund managers. SIFs can accommodate a wider range of investment strategies- from equity to debt as well as REITs, InvITs and derivatives.

There are some restrictions to ensure funds work within their framework and don’t go too aggressive with their strategies. Here are the guidelines for different instruments:

Equity:

SIFs can invest up to 15% of the company's paid-up capital with voting rights allocating a maximum of 10% of their NAV in one particular company. The 15% limit gives an advantage to the SIFs over traditional mutual funds, where the CAP is 10%.

Unlisted companies:

SIFs can invest in unlisted companies, specific sectors, industries or themes such as technology, start-ups, etc.

Debt instruments:

The exposure to a single issuer is capped at 20% of the total assets. However, there is an option to increase the cap to 25% with approval from the trustees and board of directors. This restriction is intended to limit risk, ensuring that the fund remains diversified and not overly exposed to any one entity. Another exception for debt instruments: the 20% rule does not apply if the strategy invests in government securities and treasury bills.

REITs and InvITs:

SIFs can allocate up to 20% of their assets to Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs), but they cannot allocate more than 10% in any single issuer. This ensures diversification while still allowing targeted exposure to the real estate and infrastructure sectors.

(REITs: Real Estate Investment Trusts are investment trusts (like mutual funds) that own and operate real estate properties generating regular income and capital appreciation on their investments.

InvITs: Infrastructure Investment Trusts are also like mutual funds that pool money from investors that own and operate operational infrastructure assets like highways, roads, pipelines, warehouses, power plants, etc.)

Features of SIF:

- Minimum Investment Threshold: Investors are required to commit at least 10 Lakh to invest in SIFs. This threshold is lower for accredited investors, providing them with greater flexibility.

- Investments Strategies: It offers a range of strategies including open-ended, close-ended and interval-ended. They are permitted to allocate up to 15% of their assets in a single security exceeding the 10% limit typically imposed on mutual funds.

- Target Investor: Designed for investors with higher risk appetite, SIFs bridge the gap between Mutual fund and PMS, providing access to sophisticated investment avenues without higher minimum investments usually associated with PMS.

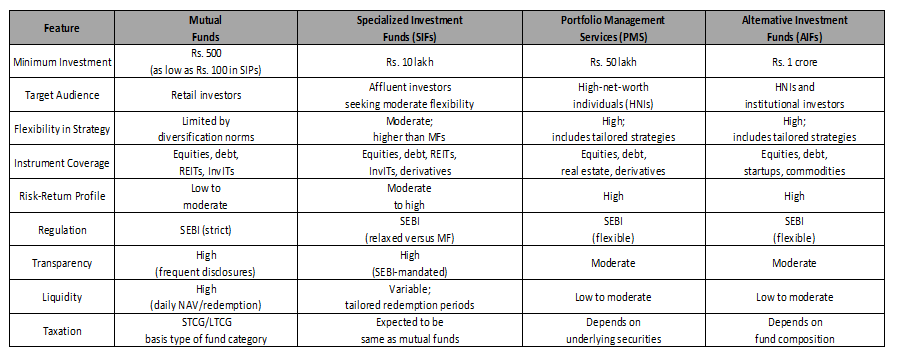

SIF Comparison:

Advantages of SIF:

- Access to unique investment opportunities: SIFs provides access to specialized investment strategies and asset classes that may not be available through traditional investment options. SIFs can invest in unlisted companies, specific sectors, industries or themes such as technology, start-ups, etc.

- Potential for higher returns: Due to the focussed approach and potentially higher risk profile SIF attracts higher returns as compared to traditional investment opportunities. These funds invest in a specific theme or sector. This targeted approach allows them to capture opportunities with higher growth potential.

Challenges and Consideration:

- Higher risks: SIFs often involve higher risks compared to traditional investment opportunities because these funds invest in specific themes or sectors so risk exposure is high in this kind of funds as compared to traditional investment opportunities.

- Limited liquidity: Some SIF investments, such as private equity or real estate may have limited liquidity, meaning it may be difficult to sell them quickly.

Conclusion:

SIFs represent a unique and dynamic approach to investing, tailored to meet the needs of affluent and institutional investors. Their focused strategies and access to exclusive asset classes and potential for higher returns set them apart from other traditional investment options. However, they also come with higher risks, limited liquidity, and complex structures, making them suitable primarily for experienced investors with a higher risk appetite and long-term goals.

For those who are looking to diversify their portfolios, gain exposure to different strategies, SIF offers an excellent avenue. No funds are available for investment now; you can visit our mutual fund screen, where we will also share SIFs when available.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: